Vodafone India: Seemingly Smart Maneouvre

Vodafone announces it has agreed to acquire companies that control a 67% interest in Hutch Essar from Hutchison Telecom International Limited (“HTIL”) for a cash consideration of US$11.1bn. Vodafone will assume net debt of approximately US$2.0 bn. The transaction implies an enterprise value of US$18.8 billion (£9.6 billion) for Hutch Essar. Vodafone has also offered to buy the 33% stake of the Essar Group and made arrangement with local partners to keep within the government 74% foreign holding limit if Essar decide to sell out. This is significantly lower than some of the US$20bn+ valuations placed on Hutchison Essar by some analysts.

One item of the transaction that definitely seems appealing on the surface is the unwinding of the 10% ownership in the #1 Indian Operator, Bharti. First, Vodafone has granted an option to sell its direct 5.6% investment for US$1.6bn to the local partner Bharti. Vodafone seems to have granted deferred payment terms for the 5.6% stake over the next 18 months. This leaves Voda with an indirect stake of 4.4% worth around US$1.3bn based upon an initial investment of US$0.8bn for the whole of the 10% stake.

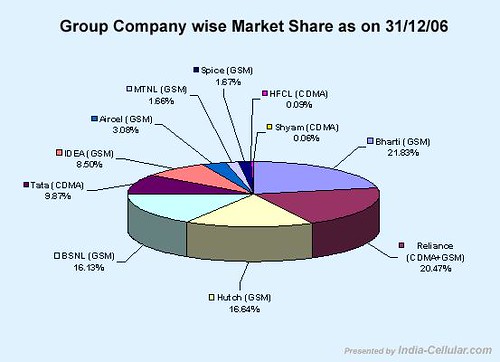

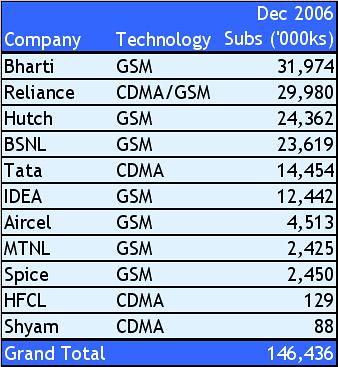

As part of this transaction, Voda has immediately allayed fear about the capital costs of roll-out of rural GSM in India. It seems that the #3 (Hutch Essar) and #1 (Bharti) will share infrastructure and which will make the investment look at lot more attractive than rolling out infrastructure solo. This potentially gives this partnership a huge advantage over the #1 CDMA operator, Reliance, and the state owned #2, BSNL and MTNL, in the GSM market.

The local major shareholder of Bharti, Sunil Mittal, seems to be making very positive noises about the partnership going forward and it does seem at first glance like a huge win-win for both parties. I would expect the other overseas operator with a shareholding in Bharti, Singtel, will be extremely disappointed that they have not picked up the Vodafone stake, however the fears will be allayed by the network sharing deal. The #1 CDMA Operator, Reliance, will be extremely disappointed that they have not won the deal, but their infrastructure partner, Qualcomm, will probably be extremely happy as they should now reinforce their commitment to CDMA technologies.

In the short term, the pressure will be on for Voda:

Even more important is the resolution of the issue of the local partner. In the press release Voda have indicated they have offered to the Essar Group terms to buy them out. The Essar Group have made noises all along in the auction process that they would try and use pre-emption rights to buy the HTIL stake that Voda have bought. It is also fair to say that the relationship between Essar and Hutchison Whampoa was extremely strained. It is really important to reduce the risk for Voda to sort out this problem as soon as possible.

In the medium to long term, Voda will no doubt look at acquiring some of the smaller Indian GSM players to gain market share. Ultimately, the aim must be to be #1 in the market.

For me, this is a stunning transaction which will transform the Voda Group growth prospects in one swoop. Voda have also managed to complete the transaction on a lower cost than some of the rumours in the press. Voda have also immediately addressed the situation with Bharti. The only potential problem is the current minority 33% holder, Essar Group. I expect to see a short term uplift in the Voda shareprice when the markets open in the morning.

One item of the transaction that definitely seems appealing on the surface is the unwinding of the 10% ownership in the #1 Indian Operator, Bharti. First, Vodafone has granted an option to sell its direct 5.6% investment for US$1.6bn to the local partner Bharti. Vodafone seems to have granted deferred payment terms for the 5.6% stake over the next 18 months. This leaves Voda with an indirect stake of 4.4% worth around US$1.3bn based upon an initial investment of US$0.8bn for the whole of the 10% stake.

As part of this transaction, Voda has immediately allayed fear about the capital costs of roll-out of rural GSM in India. It seems that the #3 (Hutch Essar) and #1 (Bharti) will share infrastructure and which will make the investment look at lot more attractive than rolling out infrastructure solo. This potentially gives this partnership a huge advantage over the #1 CDMA operator, Reliance, and the state owned #2, BSNL and MTNL, in the GSM market.

The local major shareholder of Bharti, Sunil Mittal, seems to be making very positive noises about the partnership going forward and it does seem at first glance like a huge win-win for both parties. I would expect the other overseas operator with a shareholding in Bharti, Singtel, will be extremely disappointed that they have not picked up the Vodafone stake, however the fears will be allayed by the network sharing deal. The #1 CDMA Operator, Reliance, will be extremely disappointed that they have not won the deal, but their infrastructure partner, Qualcomm, will probably be extremely happy as they should now reinforce their commitment to CDMA technologies.

In the short term, the pressure will be on for Voda:

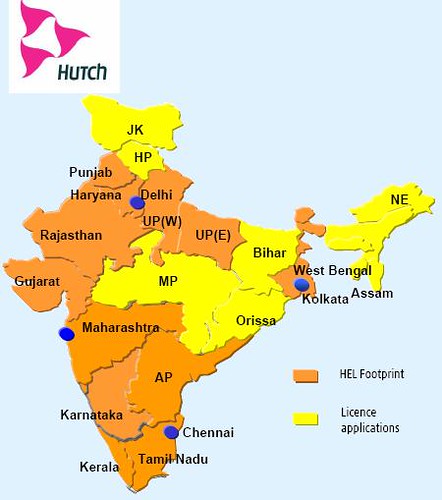

- to improve the market performance at Hutch Essar: the Voda press release indicates a market share (presumably by revenue) of 25% by FY2012;

- to rollout the Voda brand and services; and

- to rollout the network to the 6 circles where there is currently no service.

Even more important is the resolution of the issue of the local partner. In the press release Voda have indicated they have offered to the Essar Group terms to buy them out. The Essar Group have made noises all along in the auction process that they would try and use pre-emption rights to buy the HTIL stake that Voda have bought. It is also fair to say that the relationship between Essar and Hutchison Whampoa was extremely strained. It is really important to reduce the risk for Voda to sort out this problem as soon as possible.

In the medium to long term, Voda will no doubt look at acquiring some of the smaller Indian GSM players to gain market share. Ultimately, the aim must be to be #1 in the market.

For me, this is a stunning transaction which will transform the Voda Group growth prospects in one swoop. Voda have also managed to complete the transaction on a lower cost than some of the rumours in the press. Voda have also immediately addressed the situation with Bharti. The only potential problem is the current minority 33% holder, Essar Group. I expect to see a short term uplift in the Voda shareprice when the markets open in the morning.

<< Home