I am a great believer that fibre to every home and business (FTTH) in the UK is the way of the future and more importantly is desperately needed if the UK is to keep its long term economic competitiveness. I am therefore extremely disappointed today that BT has announced that they would initiate a £2.5bn share buy back programme and instead feel that BT shareholders would be better rewarded by BT deploying fibre to all uk homes.

Regulatory RegimeBT manages the UK local loop through its Openreach subsidiary and OFCOM allows BT a regulated 10% return on its investments, therefore contrary to some beliefs there is little or no risk to BT shareholders on a FTTH deployment just a regulated return at the Openreach level and potential upside at the operating unit levels (Retail, Wholesale and Services) with the sale of additional services, improving margins or market shares.

For a worked example: if it costs Openreach £10bn to deploy FTTH and the cost of borrowing is 6%, then OFCOM will guarantee Openreach an additional £400m of pre-tax profits per annum (£10bn*(10%-6%)). This is also a big tax benefit as an investment of this level will reduce BTs tax bill for many years to come. Even with a full 20% tax charge, £320m of additional earnings for BT with its current PE Ratio of 17.5 adds around £5.6bn of market capitalization for shareholders.

There is a big debate going on throughout the world about open access and regulation of fibre projects. Most of these debates are irrelevant in the UK, because there is already a separation of the network and service divisions of BT. For instance, Openreach, can provide 3 distinct network services at the exchange for all other service providers: a voice, data and broadcast video pipe with an associated tariff menu. Effectively this is only a slight development from current unbundling regime.

Operating CostsIn the 12 months to Mar-07, Openreach had operating costs of £3,289m. I seriously doubt that FTTH would add more costs to this figure. This is because in certain parts of the UK, BT’s copper network is over 70 years old – it is expensive to maintain such old plant. Also in the exchanges, some of the main distribution frames are also extremely old and we know from the local loop unbundling statistics that the fault rates associated with touching any line is extremely high.

Verizon in the US claim that operating costs have been dramatically reduced and almost pay for deployment by themselves. However, the weather in the UK is nowhere near as extreme as parts of the US. Also, Iliad in France claim that margins are higher for fibre than llu which also implies to me a cost advantage.

In the UK regulated environment, OFCOM assumes that operating costs are reduced by 1.5% per annum for regulated prices. This efficiency gain could almost certainly be increased if FTTH replaced the Copper Local Loop.

Incremental RevenueThe Openreach products would effectively be a voice, data and video “pipe”. Effectively the situation could be quite similar to the existing LLU setup with a standalone data pipe, a combined voice and data pipe and an extra product for broadcast video. This broadcast video product would be similar to the current proposal at Ebbsfleet which is the Freeview channels, the DAB channels and the Sky “satellite” channels.

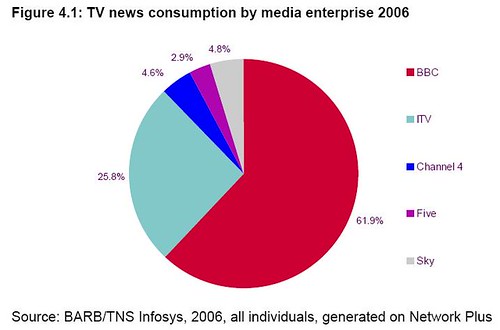

Obviously the video pipe is an additional revenue stream for Openreach. I would guess that the appeal of Freeview and DAB channels alone is limited to customers where reception of Freeview is poor or multi-dwelling units where aerials are not permitted. However, the bundling of PayTV channels would make a viable end-user service. It would also provide a third distribution channel and would probably win some market share from both Sky Satellite and Virgin Media Cable networks. Also, because Openreach is effectively a network provider with BT as its biggest customer – it would provide opportunities for a whole variety of entrants into the UK payTV market.

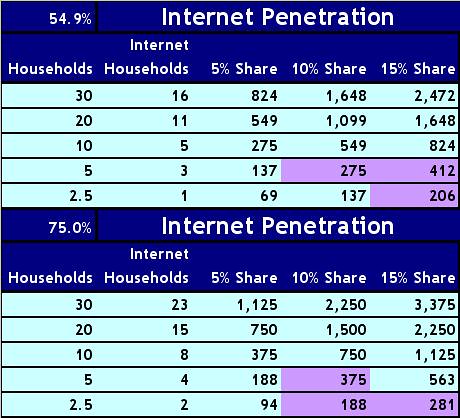

The speed of the data pipe would also be increased with the current flavour of FTTH being GPON offering 2.4-gig downstream and 1.2-gig upstream shared pipe for 32 connections. This easily allows a 100-meg down and 10-meg up service with probably 200/20 service also achievable. The speed would not be distance related as is the current case with ADSL. Obviously a higher price could be charged for these types of speed.

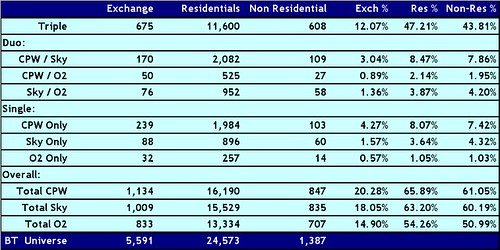

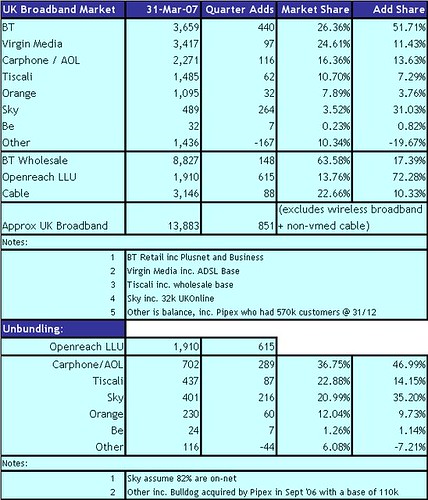

However, the biggest element of increased revenue is for Openreach to win lines back from the competition or avoid the loss of lines. According to their 1Q results, Virgin Media had around 4.8m customers with various services for Openreach to win back and gain additional revenue. This is before the business market where alternative networks such as C&W have been directly connecting companies for years.

I would expect Openreach rolling out a FTTH project to cause serious damage to both Virgin Media and C&W in the UK. For me this is a not serious concern in either economic or competition terms as long as the Openreach network in truly open and BT Retail does not have special advantages over other service providers.

Capital CostsFor a Greenfield site the cost of deployment for fibre is estimated to be similar to that of copper. The equipment and cable costs are similar and the expensive labour intensive tasks of digging trenches to lay the cable and internal home and exchange cabling have to done for either fibre or copper. For reasonable sized new housing developments, there is no reason why Openreach wouldn’t lay fibre rather copper in the future.

For a replacement of the legacy copper network, digging and internal cabling have to be repeated and this is not only expensive but disruptive to the neighbourhood. Costs can be minimized by using exiting ducts and telephone poles for overhead drops where available. These costs are normally grouped together as “cost to pass home” which are fixed whether one house or the entire street sign-up to the fibre network.

The other component is the “cost to connect” which is lighting the fibre and installing the electronics at the home and activating the fibre at the exchange. This is obvious success based.

In terms of actual costs, Verizon currently provide the benchmark with $800 per home passed and $842 per home connected quoted in their latest earnings call. There is also a

recent paper by the Broadband Stakeholder Group which quotes a study by the Enders Group that 90% of UK homes could be fibred for €14bn.

Given this, a nice round figure of £10bn won’t be too far away from the mark for the UK FTTH project.

Cost per Line EstimateAn additional £10bn of RAV (regulated asset value) for Openreach would imply an additional £1bn per annum of earnings for Openreach (before interest and tax).

The additional fibre assets would generate an additional depreciation charge of £500m pa to Openreach assuming a 20-year write-off. However, these charges need to be off-set against the current copper network depreciation because of course the copper network won’t be replaced. This is another big number: I estimated that the depreciation charge is around £250m per annum. The basis for this assumption is because the current £11.3bn of RAV will include quite a few items outside of copper plant such as the actual exchanges and I’m trying to be conservative. This leads to total additional earnings required at Openreach of approximately £1,250m per annum.

We also have to look at the cost savings from operating the fibre rather than copper. With Openreach annual operating costs running at around £3,289m per annum, it would not be beyond the realms of possibility to expect £150m of annual savings.

This leaves the net regulated increased revenue at Openreach of approximately £1,100m. Of course, this is before the incremental revenue from video services, increased bandwidth and increased market share. The £1,100m revenue across the 22 million lines in the UK equates to around £50 per line per annum or £4 per month charge.

Obviously there would be a big debate with OFCOM on how much of the regulated return should be borne by lines on the existing copper network as opposed to new fibre homes. My own thought is that the whole of the UK network should bear as much cost as is politically possible and therefore the costs are spread over as many lines as possible. If a huge differential in price between services delivered over copper and over fibre exists then there is less incentive to people to swap and a big reduction in the possibility of ever sunsetting the copper network.

In my opinion, one way this problem could be solved would be to have a price list for a raw data and voice pipe whether delivered over fibre or copper as under the current WLR and LLU regime. There would be an incremental price for high speed broadband over fibre and another price for broadcast video. These incremental prices should be calculated to cover the success based element of the fibre network, in other words the cost to connect over the estimated life of the customer electronics which would be around 5 years. This would work out with costs to connect of around £500 to £8.33 per month for the network charges for both high speed fibre data and broadcast video which I think is reasonable. This would also mean with around 50% of the costs would be in cost to pass or an additional £2/month to everyone’s line rental.

RolloutI think one of the better BT ideas over recent times was the registration scheme allowing the aggregation of demand to enable BT to justify enabling broadband in rural exchanges. I would recommend BT adopt a similar scheme for determining the rollout of FTTH across the country – effectively rolling out to suburbs where demand is greatest and thereby reducing the risk of low uptake. It would also provide a comeback against the luddites in neighbourhoods who will inevitably complain when the roads are being dug up.

ConclusionThe recent decisions by the French operators and Verizon in the US to roll out FTTH without large scale government subsidies prove that the economics can be made to work. The special situation in the UK where Openreach prices are regulated, actually mean that the project is less risky for BT Shareholders. BT just requires approval on how the costs are to be apportioned.

The big question in my mind is why BT is not pushing ahead presenting a FTTH project. I can see that BT would want to minimize changes and therefore risk while they are upgrading the core network with the 21CN. Realistically, I can see a big project like FTTH with regulated returns would take around a year of navel gazing and negotiation before OFCOM would approve it. By which time there will be large areas of the country where 21CN is implemented.

The only reason I can think of is that BT does not think there is currently enough political and end-user support for such a project. This support will build over time as more or more cities and homes within Europe are connected with fibre and the UK falls further and further behind. Support will also build as more and more consumers become frustrated by the UK speeds and find that services such as video streaming over the internet only work at low quality.

From my position, it is just extremely frustrating waiting for BT to kick-off the project.

Hat Tip to Stefano Quintarelli for his more than valuable recent assistance and by the way his campaign for FTTH in Italy is more than brilliant.

Hat Tip to Stefano Quintarelli for his more than valuable recent assistance and by the way his campaign for FTTH in Italy is more than brilliant.