Setanta: Squandered Opportunity?

Whilst I’m sat in my daily traffic jam having my eyeballs assaulted by a huge yellow signage offering yet more English Premiership Football (FAPL) for an additional £10/month with no long term contractual commitment, I am drawn to whether the Setanta move into the FAPL is some sort of kamikaze manoeuvre or a long term attempt to overcome the barriers to entry in a potentially lucrative market.

My initial thinking of the basic economics of the FAPL deal goes along the lines of:

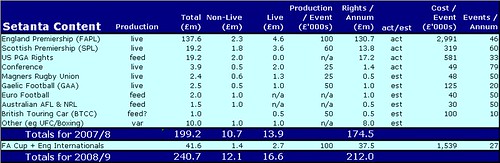

However the overall economics of Setanta are far more complicated that just the FAPL deal with multiple content rights and multiple distribution platforms.

The complications are as follows:

Corporate Costs

Some of the Marketing budgets in the TV Industry are absolutely immense: Sky spent £70m in the first six months of this year and Virgin Media spent £37m. Obviously, I wouldn’t expect Setanta to be able to afford anywhere near those sums of money, but I wouldn’t be surprised if they planned on spending £10m in this year. Channel 4 spent £29.7m on marketing its main channel and £15.7m on marketing its three digital franchises (E4, More4 and Film4) in 2006/7. £10m won’t buy a lot of promotion for Setanta in 2007.

The Transmission Costs at Setanta will also be heavy with the cost of a DTT channel to pay for. The current market price of these channels is about £10m per annum, but Setanta might have a “deal” with TopUpTV to promote their payTV platform. Setanta also has 9 satellite channels and has to pay fees to Astra for this capacity, although nowhere near as expensive as DTT capacity. I suspect this could be another £2m. The wholesale deals on Virgin Media and the iptv channels are probably “carriage included” so there will be nothing to pay there. However, the internet costs could add up if the Setanta Broadband solution takes off with 600kbps streams. All told I expect the transmission costs to be around £12m/annum.

G&A (General & Administration aka overheads) is another figure which is difficult to estimate, but given some of the heavyweights on the Setanta management team, the high costs of negotiating overseas sports rights and the cost of London operations - £8m per annum would be absolute minimum.

This would give a run-rate of £30m per annum or £2.5m/month. On the Satellite Revenue per Subscriber this equates to 383k subscribers just to cover the Corporate Bill. Allegedly, Setanta only had 170k subscribers in the UK before this season and this gives yet another indicator of the size of the mountain that Setanta have to scale.

Wholesale Deals

Setanta has a wholesale deal with Virgin Media for the supply of its channels. Virgin Media fulfils all sales, marketing and support costs for these customers. Virgin Media have bundled six of the nine channels as part of its XL TV package which currently has around 1.4m customers. Obviously, Virgin Media will have given Setanta a substantial discount on the retail price, in the press wholesale prices have been estimated around £2.00 - £2.50/month. I would add to this that Setanta probably has some revenue share agreements in place which I guessestimate at 30p/sub (see below), so my guess on top-end return of the deal is £2.20/month.

The potential upside for Virgin Media is to upsell to its existing base of non-TV subscribers and non-XL subscribers – this is a potential market of over 2.5m customers. Personally, I think it is a difficult sell and Virgin Media will have done well to convert 10% of their potential market by the end of the 2007/8 season.

So my top end estimate for the value of the Virgin Media wholesale deal is £3.63m/month or approx £44m/annum.

Setanta also has a significant wholesale deal with Sky for supply of its channels to pubs and clubs. The Sky monthly revenue on these business contracts is significantly higher than in retail and I’d heard estimates on the jungle grapevine ranging from £70/month to £2,400/month. I’ve also heard that Sky have around 40k business customers across the UK – this is significant revenue.

Sky actually is in a really unenviable position with this contract, because it has to be perceived as playing extremely fair with Setanta who is only playing in the FAPL game because of a last minute adjudication by an EU referee. I am wildly guessing here that the average revenue to Setanta is around £50/pub/month which would give a monthly run rate of £2m or annual turnover of £24m.

The other wholesale deals with the iptv vendors (BT & Tiscali) will probably be insignificant in both the short and medium terms. Setanta will be lucky to get a couple of million a year from them.

In other words wholesale deals will bring in around £70m of total annual running costs of £230m (content = £200m and corporate = £30m) which is not bad given that most of this money is guaranteed and easy to collection.

Revenue Sharing

I have not included the cost of the content on the Racing Channels, Celtic & Ranger TV and NASN on the Content Rights Calculation; this is because I suspect that these are run in some form of partnership agreement with the ultimate owners of the content.

Revenue sharing deals are notoriously complex and usually they are not just as easy as a standard price per subscriber. People like NASN, Celtic, Rangers and Racing UK will be looking to cover their costs with some sort of upside. The theory for Setanta is that the Racing nuts will be quite happy to pay an additional £10/month for their sport and will see the rest of the content as a bonus.

The other problem to factor into the equation is that NASN, which holds the rights to MLB and various American Sports was owned by Setanta but was sold late in 2006 to ESPN, owned by Disney, for €70m (including debt). This is a big number for a channel basically serving a very, very niche market in Europe and with some heavy content being bundled.

Some of the content channels deals in the USA within the cable family are legendary for both their complexity and almost magical sleights of hands to the financial community. The Irish are extremely quick learners and this Setanta/ESPN deal may be modelled on previous US deals.

The net effect is that I’m going to ballpark 10p/month/subscriber for the four channel deals, but I could be wildly wayward.

Customer Acquisition and Churn

The big surprise to me was that there was no contract and this worry has probably been ingrained into me from predominately dealing with oligopolistic markets such as mobile and broadband where the consumer is currently faced with a more or less similar product from various suppliers.

Setanta is not in that type of market. I think it is basically playing to three types of customers:

I subscribed to SkySports for the 1994 England tour of the West Indies – I could not take another series in the West Indies after the 1990 tour and my time spent in the local hostelry nearly caused permanent liver damage. For approximately 11 years, I had been out of contract with Sky until the recent acquisition of a Sky+ box. In fact, I’ve been through two moves where I just re-signed without knowing of the contract length.

Setanta has Trevor East who has been on TV sports, including a stint at Sky, for basically ever guided the path and he will understand the UK Sports PayTV market as well as anyone. Currently we are at only a £160m shortfall for Setanta which is actually only 2.2m SkySports at £6.12/month (after a 50p revenue sharing deal) out of a base of around 5m Skysports subscribers. Obviously, Setanta doesn’t think they can achieve these numbers and that is why they are pushing so heavily in the not-so-Freeview space.

Personally, I think Freeview as a distribution platform is a huge mistake: not only because it is an expensive choice because of the scarcity and of DTT spectrum and poor coverage; not only because Setanta will be holding the innovation torch by trying to acquire customers on a yet to be scaled platform; not only because of a cracked encryption scheme in the marketplace; not only because the majority of the potential additional 9m customers don’t have set-top boxes able to view the Setanta channels; but mainly because the people who are willing to pay for Sport are already on SkySports. Additionally, Sky are not standing still and are busy targeting the niche Sports fan yet to come onboard – witness the improved coverage of Tennis in recent years, the ramping up of Yachting coverage and the addition of Squash and Badminton to the schedule.

Personally, I think the Freeview experiment will be the undoing of Setanta without Sky even having to turn the screw. Bad publicity is potentially the death of any business and I don’t see anything positive coming soon from the newly and expensively acquired Freeview base.

Wrapping Up

It doesn’t take Sigmund Freud to figure out a future for Setanta if they concentrate on wholesale deals, the SkySports satellite customer base and supplying cheap niche content for niche customers yet to sign up to large expensive sports bundles. Instead the Setanta Executive Management Team Testerone levels seem to have gone into full turbocharged mode. Setanta should have been far more honest in their psychoanalysis and admitted that the job of secondary rights holders is to profitably piggy back on the primary rights holders.

A duopoly in the provision of payTV sports in the UK would be almost certainly very acceptable to every EU regulator, especially when practices in other countries are examined.

The current Duopolists have been presented with a relatively simple and idiot proof task of purchasing further sporting rights, viewing figures and thereby undermining further the Free-to-Air business model.

However, I think Setanta have blown it by trying to accelerate the unconverted onto an untried payTV platform without offering the full range of payTV sports ie SkySports + Setanta Sports – this could have been a workable solution.

A £160m shortfall sounds quite a lot, but spread across the 5m SkySports retail viewers it is only a drop in the ocean at an extra £2.66 per month wholesale. Remember, that the Sky ARPU for the 12-months to Jun-07 was £412.

For me the solution to the business model conundrum was for Setanta to get BSkyB to realise that two players in the Sports content business in the UK is the perfect solution for all stakeholders: regulators, sporting bodies and viewers and much better than one.

Personally given the current practices, I can’t see a scenario whereby Setanta will cover its costs over the current 3-year length of the FAPL contact, especially given that things are going to get far tougher next year with the additional FA contract costs of around £41.6m.

My initial thinking of the basic economics of the FAPL deal goes along the lines of:

- £10/month gross revenue equals £8.51 per subscriber per month net of VAT

- Sky Conditional Access change is £0.99/sub/month as per Annex 3 of their regulated rate card

- Assume that Billing and Customer Support charges are approx. £1/sub/month which is lower than typical ISP support costs.

- This leaves net revenue of £6.52/sub/month.

- The content deal with the Premier League (FAPL) was £392m for three seasons with 46 games per season.

- This works out at an amazing average of £2.84m per game and this is for second rate fixtures on Saturday Evening (ie no local derbies) and Monday Evening (ie no top notch clubs involved in playing midweek European games).

- On top of the FAPL content deal is the live production costs which I would guess at a minimum will have to at least match Sky’s quality and I estimate to be around £100k/match given the multitude of cameramen, mixing, editing, commentary and uplinks. Ergo, another £4.6m per annum.

- On top of the content rights & live production, there are the shows talking about the show. In other words, the production of the talking shops programmes and all the countless highlights packages. I would estimate that this would cost around half as much as the actual live football productions or another £2.3m.

- Therefore football costs are content rights - £130.7m/year, live production - £4.6m and other shows - £4.6m giving a total of around £137.6m/year

- The total breakeven number of subscribers is an additional 1,758k just on the FAPL rights and assuming Satellite platform like costs of distribution.

However the overall economics of Setanta are far more complicated that just the FAPL deal with multiple content rights and multiple distribution platforms.

The complications are as follows:

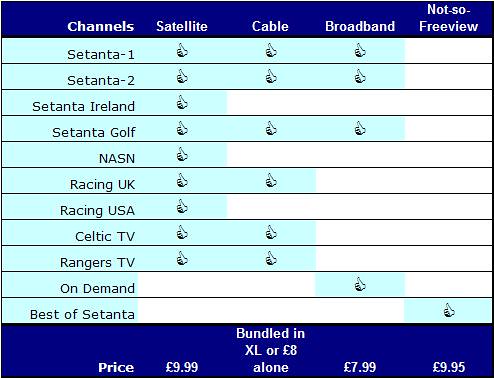

- Setanta offers a bundle of up to 9 channels with other less expensive content rights such as the FA Cup, Scottish Premier League, USPGA Golf and the rest.

- Setanta has corporate expenses such as Marketing, Transmission Costs and G&A (overheads) and to factor in.

- Setanta has wholesale deals with Virgin Media for cable distribution and Sky for Pubs and Clubs which are significant deals. It also has wholesale IPTV deals with BT and Tiscali which are probably not-so-significant.

- Revenue Sharing – some of the Setanta bundle such as NASN (North American Sports Network owned by ESPN), RacingTV (owned by 30 racecourses), Celtic and Rangers TV probably have some sort of revenue share.

- Setanta also has a not-so-Freeview distribution option and a Broadband channel

- The twin temples of doom – Subscriber Acquisition Costs and Churn – also need to be factored in.

Corporate Costs

Some of the Marketing budgets in the TV Industry are absolutely immense: Sky spent £70m in the first six months of this year and Virgin Media spent £37m. Obviously, I wouldn’t expect Setanta to be able to afford anywhere near those sums of money, but I wouldn’t be surprised if they planned on spending £10m in this year. Channel 4 spent £29.7m on marketing its main channel and £15.7m on marketing its three digital franchises (E4, More4 and Film4) in 2006/7. £10m won’t buy a lot of promotion for Setanta in 2007.

The Transmission Costs at Setanta will also be heavy with the cost of a DTT channel to pay for. The current market price of these channels is about £10m per annum, but Setanta might have a “deal” with TopUpTV to promote their payTV platform. Setanta also has 9 satellite channels and has to pay fees to Astra for this capacity, although nowhere near as expensive as DTT capacity. I suspect this could be another £2m. The wholesale deals on Virgin Media and the iptv channels are probably “carriage included” so there will be nothing to pay there. However, the internet costs could add up if the Setanta Broadband solution takes off with 600kbps streams. All told I expect the transmission costs to be around £12m/annum.

G&A (General & Administration aka overheads) is another figure which is difficult to estimate, but given some of the heavyweights on the Setanta management team, the high costs of negotiating overseas sports rights and the cost of London operations - £8m per annum would be absolute minimum.

This would give a run-rate of £30m per annum or £2.5m/month. On the Satellite Revenue per Subscriber this equates to 383k subscribers just to cover the Corporate Bill. Allegedly, Setanta only had 170k subscribers in the UK before this season and this gives yet another indicator of the size of the mountain that Setanta have to scale.

Wholesale Deals

Setanta has a wholesale deal with Virgin Media for the supply of its channels. Virgin Media fulfils all sales, marketing and support costs for these customers. Virgin Media have bundled six of the nine channels as part of its XL TV package which currently has around 1.4m customers. Obviously, Virgin Media will have given Setanta a substantial discount on the retail price, in the press wholesale prices have been estimated around £2.00 - £2.50/month. I would add to this that Setanta probably has some revenue share agreements in place which I guessestimate at 30p/sub (see below), so my guess on top-end return of the deal is £2.20/month.

The potential upside for Virgin Media is to upsell to its existing base of non-TV subscribers and non-XL subscribers – this is a potential market of over 2.5m customers. Personally, I think it is a difficult sell and Virgin Media will have done well to convert 10% of their potential market by the end of the 2007/8 season.

So my top end estimate for the value of the Virgin Media wholesale deal is £3.63m/month or approx £44m/annum.

Setanta also has a significant wholesale deal with Sky for supply of its channels to pubs and clubs. The Sky monthly revenue on these business contracts is significantly higher than in retail and I’d heard estimates on the jungle grapevine ranging from £70/month to £2,400/month. I’ve also heard that Sky have around 40k business customers across the UK – this is significant revenue.

Sky actually is in a really unenviable position with this contract, because it has to be perceived as playing extremely fair with Setanta who is only playing in the FAPL game because of a last minute adjudication by an EU referee. I am wildly guessing here that the average revenue to Setanta is around £50/pub/month which would give a monthly run rate of £2m or annual turnover of £24m.

The other wholesale deals with the iptv vendors (BT & Tiscali) will probably be insignificant in both the short and medium terms. Setanta will be lucky to get a couple of million a year from them.

In other words wholesale deals will bring in around £70m of total annual running costs of £230m (content = £200m and corporate = £30m) which is not bad given that most of this money is guaranteed and easy to collection.

Revenue Sharing

I have not included the cost of the content on the Racing Channels, Celtic & Ranger TV and NASN on the Content Rights Calculation; this is because I suspect that these are run in some form of partnership agreement with the ultimate owners of the content.

Revenue sharing deals are notoriously complex and usually they are not just as easy as a standard price per subscriber. People like NASN, Celtic, Rangers and Racing UK will be looking to cover their costs with some sort of upside. The theory for Setanta is that the Racing nuts will be quite happy to pay an additional £10/month for their sport and will see the rest of the content as a bonus.

The other problem to factor into the equation is that NASN, which holds the rights to MLB and various American Sports was owned by Setanta but was sold late in 2006 to ESPN, owned by Disney, for €70m (including debt). This is a big number for a channel basically serving a very, very niche market in Europe and with some heavy content being bundled.

Some of the content channels deals in the USA within the cable family are legendary for both their complexity and almost magical sleights of hands to the financial community. The Irish are extremely quick learners and this Setanta/ESPN deal may be modelled on previous US deals.

The net effect is that I’m going to ballpark 10p/month/subscriber for the four channel deals, but I could be wildly wayward.

Customer Acquisition and Churn

The big surprise to me was that there was no contract and this worry has probably been ingrained into me from predominately dealing with oligopolistic markets such as mobile and broadband where the consumer is currently faced with a more or less similar product from various suppliers.

Setanta is not in that type of market. I think it is basically playing to three types of customers:

- Your typical sports fan who already pays for the range of Sky Sports content through either Sky or Virgin and wanting a £10/month with Sky or Free with Virgin top-up for some new content;

- Your niche sports fan who would take a sports package if only their favourite flavour of sport was covered. This is the market that Gaelic Sport, BTCC, Aussie Sport, US sport & UFC fans are being catered for; and

- Your sports fan that is economically challenged, but can afford to go down the pub and watch it on a big screen.

I subscribed to SkySports for the 1994 England tour of the West Indies – I could not take another series in the West Indies after the 1990 tour and my time spent in the local hostelry nearly caused permanent liver damage. For approximately 11 years, I had been out of contract with Sky until the recent acquisition of a Sky+ box. In fact, I’ve been through two moves where I just re-signed without knowing of the contract length.

Setanta has Trevor East who has been on TV sports, including a stint at Sky, for basically ever guided the path and he will understand the UK Sports PayTV market as well as anyone. Currently we are at only a £160m shortfall for Setanta which is actually only 2.2m SkySports at £6.12/month (after a 50p revenue sharing deal) out of a base of around 5m Skysports subscribers. Obviously, Setanta doesn’t think they can achieve these numbers and that is why they are pushing so heavily in the not-so-Freeview space.

Personally, I think Freeview as a distribution platform is a huge mistake: not only because it is an expensive choice because of the scarcity and of DTT spectrum and poor coverage; not only because Setanta will be holding the innovation torch by trying to acquire customers on a yet to be scaled platform; not only because of a cracked encryption scheme in the marketplace; not only because the majority of the potential additional 9m customers don’t have set-top boxes able to view the Setanta channels; but mainly because the people who are willing to pay for Sport are already on SkySports. Additionally, Sky are not standing still and are busy targeting the niche Sports fan yet to come onboard – witness the improved coverage of Tennis in recent years, the ramping up of Yachting coverage and the addition of Squash and Badminton to the schedule.

Personally, I think the Freeview experiment will be the undoing of Setanta without Sky even having to turn the screw. Bad publicity is potentially the death of any business and I don’t see anything positive coming soon from the newly and expensively acquired Freeview base.

Wrapping Up

It doesn’t take Sigmund Freud to figure out a future for Setanta if they concentrate on wholesale deals, the SkySports satellite customer base and supplying cheap niche content for niche customers yet to sign up to large expensive sports bundles. Instead the Setanta Executive Management Team Testerone levels seem to have gone into full turbocharged mode. Setanta should have been far more honest in their psychoanalysis and admitted that the job of secondary rights holders is to profitably piggy back on the primary rights holders.

A duopoly in the provision of payTV sports in the UK would be almost certainly very acceptable to every EU regulator, especially when practices in other countries are examined.

The current Duopolists have been presented with a relatively simple and idiot proof task of purchasing further sporting rights, viewing figures and thereby undermining further the Free-to-Air business model.

However, I think Setanta have blown it by trying to accelerate the unconverted onto an untried payTV platform without offering the full range of payTV sports ie SkySports + Setanta Sports – this could have been a workable solution.

A £160m shortfall sounds quite a lot, but spread across the 5m SkySports retail viewers it is only a drop in the ocean at an extra £2.66 per month wholesale. Remember, that the Sky ARPU for the 12-months to Jun-07 was £412.

For me the solution to the business model conundrum was for Setanta to get BSkyB to realise that two players in the Sports content business in the UK is the perfect solution for all stakeholders: regulators, sporting bodies and viewers and much better than one.

Personally given the current practices, I can’t see a scenario whereby Setanta will cover its costs over the current 3-year length of the FAPL contact, especially given that things are going to get far tougher next year with the additional FA contract costs of around £41.6m.

<< Home